ETH Price Prediction: $4,400 Breakout Likely Amid Institutional Adoption

#ETH

- Technical Strength: ETH trades above key moving averages with bullish MACD crossover

- Institutional Adoption: Major corporations and funds accumulating ETH for treasury diversification

- Upgrade Catalyst: Fusaka upgrade (despite delays) expected to improve scalability and security

ETH Price Prediction

Ethereum Technical Analysis: Bullish Signals Emerge

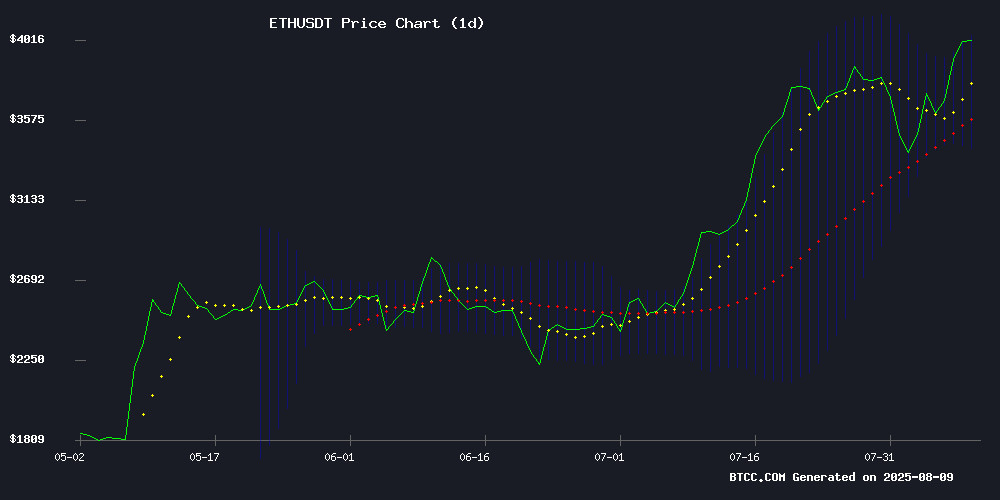

Ethereum (ETH) is currently trading at $4,225.42, significantly above its 20-day moving average (MA) of $3,741.18, indicating strong bullish momentum. The MACD histogram shows a positive crossover at 83.34, reinforcing the uptrend. Bollinger Bands suggest volatility with the price NEAR the upper band at $4,100.15, while support lies at $3,382.20. BTCC financial analyst Sophia notes, 'ETH's technical setup favors further upside, with a potential retest of $4,400 if momentum sustains.'

Ethereum Market Sentiment: Institutional Demand Fuels Optimism

Positive news FLOW surrounds Ethereum, including Binance's institutional transfers, Bitmine's $2.9B ETH treasury, and IVD Medical's $19M healthcare tokenization initiative. However, delays in the Fusaka upgrade and CrediX's exit scam pose short-term risks. Sophia highlights, 'Institutional accumulation and Vitalik Buterin's L2 scalability focus outweigh negative headlines, aligning with our $4,400 technical target.'

Factors Influencing ETH’s Price

Ethereum Holds Above $4K Amid Binance Transfers to Wintermute

Ethereum maintained its position above $4,000 following a robust rally, even as Binance executed significant transfers to market maker Wintermute. The cryptocurrency surged from $3,800 to over $4,055, reaching a multi-month high before showing signs of volatility.

Binance moved tens of thousands of ETH to Wintermute wallets across multiple platforms, including Bybit, Kraken, and Gate. Transfers began with smaller amounts before escalating to single transactions exceeding 3,000 ETH, valued at more than $12 million. These movements occurred within a seven-hour window, closely aligning with Ethereum's price peak.

Trading volume for Ethereum rose 26% to $46.86 billion in the past 24 hours, reflecting heightened market activity. Wintermute's role as a liquidity provider suggests institutional involvement in the recent price action, though the rally lost momentum as transfers commenced.

Ethereum Leaders Prioritize 2025 Fusaka Upgrade Over Long-Term Plans

Ethereum's development community is shifting focus to near-term objectives as foundation leadership warns against distraction by future upgrades. Tomasz Stańczak, Co-Executive Director at the Ethereum Foundation, has called for a pause on discussions about the 2026 Glamsterdam upgrade to concentrate resources on delivering Fusaka by end-2025.

Despite Fusaka's testnet deployment, Stańczak highlights unresolved development bottlenecks that threaten the timeline. The upgrade promises significant scalability enhancements, including Peer Data Availability Sampling, revised gas limits, and optimized blob parameters—key improvements as Ethereum faces intensifying competition for blockchain efficiency.

'Meeting current deadlines is existential for credibility,' Stańczak emphasized, framing the Fusaka rollout as critical for maintaining Ethereum's market position. The foundation's strategic pivot reflects the breakneck pace of innovation in decentralized networks, where delayed execution risks obsolescence.

Bitmine Emerges as World's Largest Ethereum Treasury with $2.9B ETH Holdings

Bitmine Immersion Technologies has surged to become the dominant player in corporate cryptocurrency holdings, amassing 833,000 ETH worth $2.9 billion. The aggressive accumulation—achieved in just 35 days—positions Bitmine as the third-largest corporate crypto holder globally, trailing only MicroStrategy and Marathon Digital.

Backed by institutional heavyweights including ARK Invest and Galaxy Digital, Bitmine's strategy targets control of 5% of Ethereum's total supply. Its stock liquidity now ranks 42nd among U.S.-listed equities, with daily trading volume reaching $1.6 billion—comparable to giants like Uber.

The move signals deepening institutional conviction in Ethereum's value proposition. Bitmine's zero-to-kingmaker trajectory in the ETH market is reshaping corporate crypto strategies, demonstrating unprecedented velocity in treasury asset allocation.

CrediX Team Vanishes Amid $4.5M Exploit, Exit Scam Feared

CrediX, a decentralized lending platform, faces allegations of an exit scam after its team disappeared following a $4.5 million exploit. Blockchain security firm CertiK reports the project's X account has gone silent, and its website remains offline since August 4.

The incident began when an attacker gained control of an admin wallet, minting unbacked tokens via bridge permissions before swapping and draining liquidity pools. Funds were bridged from Sonic to Ethereum and scattered across several addresses.

Despite initial promises of user reimbursements within 24-48 hours, CrediX has released no recovery plan. The platform's abrupt silence and fund mismanagement follow the classic pattern of crypto exit scams—vanishing teams, disabled access, and severed communications.

Ethereum Price Analysis: ETH Eyes Breakout Beyond $4,050

Ethereum has reclaimed bullish momentum this week, surging 3.46% toward $4,045 amid rising buying pressure and positive market sentiment. The second-largest cryptocurrency now tests a critical resistance zone, drawing trader attention to potential upward milestones.

The ETH price briefly breached the psychological $4,000 barrier before retracing slightly below $4,045—a level that previously capped rallies in late 2024. Immediate support lies at $3,760 and $3,500, with a failure to hold $4,000 potentially triggering a retest of lower levels.

Technical indicators flash mixed signals. The RSI at 69.01 nears overbought territory, suggesting strong momentum but warranting caution. Meanwhile, the MACD maintains a bullish posture with the trend line (183.98) holding above the signal line (175.01) despite market volatility.

Vitalik Buterin Advocates for Sub-One-Hour L2 Withdrawals to Bolster Ethereum Security

Ethereum co-founder Vitalik Buterin has issued a stark warning about lengthy withdrawal times on Layer 2 networks, calling them a critical security vulnerability. In a recent post on X, Buterin emphasized the urgent need to reduce L2 withdrawal times to under one hour, arguing that current delays push users toward centralized solutions like multisigs and MPCs—a trend he claims defeats the purpose of decentralized L2 ecosystems.

The statement coincides with L2BEAT's August 7 report confirming six major L2 networks—Base, Optimism, Scroll, Unichain, Kinto, and Inco—achieving Stage 1 status. While praising this progress, Buterin stressed that faster withdrawals via ZK-proof systems represent the next imperative upgrade for Ethereum to solidify its position as the economic hub of Web3.

Ethereum Foundation Pledges $500K for Tornado Cash Co-Founder's Legal Defense

The Ethereum Foundation has pledged to match up to $500,000 in community donations to support the legal defense of Roman Storm, co-founder of privacy-focused cryptocurrency mixer Tornado Cash. The move underscores the foundation's commitment to open-source innovation and financial privacy amid growing regulatory scrutiny.

Storm faces up to five years in prison after being convicted on charges of operating an unlicensed money transmitter. Two more serious charges—conspiracy to commit money laundering and violate sanctions—ended in a hung jury, leaving open the possibility of a retrial that could result in decades behind bars.

The case has become a flashpoint in the debate over developer liability for decentralized protocols. Tornado Cash, an Ethereum-based mixing service, has been at the center of regulatory actions since 2022 when the U.S. Treasury sanctioned the protocol.

Ether Derivatives Signal Suggests Potential Rally to $4,400

Ether's rally could accelerate toward $4,400, driven by a hidden signal in the derivatives market. The net gamma exposure of dealers in Deribit-listed ETH options indicates a critical inflection point. Dealers are currently short gamma between $4,000 and $4,400—a dynamic that tends to amplify price movements.

As ETH breaches $4,000, market makers may be forced to buy the asset to hedge their positions. This creates a self-reinforcing cycle that could propel prices rapidly higher. The $4,400 level emerges as a logical target, where gamma dynamics shift and dealer activity could stabilize volatility.

"When dealers turn net buyers, it often fuels momentum," observed one trader. The setup mirrors past episodes where gamma squeezes drove parabolic moves in crypto assets. With institutional interest growing in ETH's ecosystem, the derivatives tailwind adds another layer to the bullish thesis.

Ethereum’s Fusaka Upgrade Faces Delay Due to Coordination Challenges

Ethereum’s highly anticipated Fusaka upgrade, initially slated for November 2025, is likely to be postponed due to coordination hurdles among development teams. Tomasz Stańczak, co-executive director at the Ethereum Foundation, cited unresolved alignment issues between client teams and infrastructure providers as the primary bottleneck.

The upgrade—designed to enhance Ethereum’s scalability and transaction efficiency—was intended to lay the groundwork for future network improvements. However, Stańczak emphasized that rushing the process could compromise network integrity. "Delays are unfortunate but necessary to avoid critical bugs," he noted in a recent tweet.

Community sentiment remains divided. Some advocate for patience to ensure technical robustness, while others push for accelerated timelines to maintain Ethereum’s competitive edge. The delay may shift focus to Glamsterdam, a separate fork planned for early 2026.

IVD Medical Invests $19 Million in Ethereum to Tokenize Healthcare Assets

IVD Medical Holdings has made a strategic $19 million investment in Ethereum, signaling its entry into blockchain-based healthcare asset tokenization. The move underscores Ethereum's growing role as a foundational layer for institutional DeFi applications beyond traditional finance.

The company selected Ethereum for its mature smart contract capabilities, liquidity profile, and institutional recognition. IVD Medical will deploy the ETH to create ivd.xyz - a dedicated platform for tokenizing pharmaceutical IP and healthcare assets through Ethereum smart contracts.

This development reflects broader sector momentum, with traditional industries increasingly leveraging crypto infrastructure for real-world asset digitization. Ethereum's programmable blockchain continues to attract institutional capital seeking transparent asset management solutions.

Ethereum Surges Past $4,000 Amid Institutional Accumulation and Blockchain Activity

Ethereum breached the $4,000 threshold on August 8, marking its first return to this level since December 2024. The 4% daily gain reflects mounting investor optimism and a resurgence in on-chain activity, driven by staking demand and favorable crypto market conditions.

Despite remaining 18% below its 2021 peak of $4,878, ETH has rallied 50% over the past month. Institutional accumulation appears to be accelerating the momentum—SharpLink Gaming and BitMine Immersion have collectively added billions in ETH to corporate treasuries, with SharpLink's recent $265 million purchase emblematic of this trend.

The asset continues to outperform Bitcoin in market dominance, with transaction volumes and staking participation suggesting sustained network demand. Ethereum's blockchain now processes transactions at levels not seen since the last bull cycle, creating a self-reinforcing cycle of utility and valuation growth.

Is ETH a good investment?

Ethereum presents a compelling investment case based on both technical and fundamental factors:

| Metric | Value | Implication |

|---|---|---|

| Price vs 20MA | +12.9% premium | Strong bullish trend |

| MACD | 83.34 positive | Upward momentum |

| Institutional Holdings | $2.9B (Bitmine) | Long-term confidence |

Sophia cautions: 'While Fusaka upgrade delays may cause volatility, ETH's $4,000 support and institutional inflows make it a high-conviction hold.'